Not known Facts About Hsmb Advisory Llc

Table of ContentsEverything about Hsmb Advisory LlcThe Best Strategy To Use For Hsmb Advisory LlcThe Main Principles Of Hsmb Advisory Llc Indicators on Hsmb Advisory Llc You Need To Know

Life insurance policy is especially crucial if your family members is dependent on your income. Market specialists suggest a policy that pays out 10 times your yearly earnings. When estimating the amount of life insurance policy you require, element in funeral service costs. After that calculate your household's day-to-day living expenses. These may include mortgage payments, superior fundings, charge card financial obligation, tax obligations, childcare, and future university expenses.Bureau of Labor Data, both partners worked and brought in revenue in 48. 9% of married-couple family members in 2022. This is up from 46. 8% in 2021. They would certainly be most likely to experience monetary difficulty as a result of among their breadwinner' fatalities. Medical insurance can be gotten via your company, the federal medical insurance industry, or private insurance you get for on your own and your household by contacting medical insurance companies straight or undergoing a health insurance policy representative.

2% of the American populace was without insurance policy protection in 2021, the Centers for Illness Control (CDC) reported in its National Center for Health Data. More than 60% got their protection with a company or in the personal insurance coverage industry while the remainder were covered by government-subsidized programs including Medicare and Medicaid, experts' benefits programs, and the government industry developed under the Affordable Care Act.

Some Known Questions About Hsmb Advisory Llc.

If your revenue is reduced, you might be one of the 80 million Americans who are eligible for Medicaid.

Investopedia/ Jake Shi Long-lasting special needs insurance sustains those that come to be not able to work. According to the Social Protection Management, one in 4 workers going into the workforce will end up being impaired before they get to the age of retirement. While health and wellness insurance coverage pays for a hospital stay and clinical bills, you are usually burdened with every one of the costs that your paycheck had actually covered.

Several plans pay 40% to 70% of your income. The price of impairment insurance policy is based on numerous factors, including age, way of living, and wellness.

Prior to you buy, check out the great print. Lots of strategies call for a three-month waiting period before the insurance coverage kicks in, give a maximum of three years' well worth of insurance coverage, and have considerable plan exemptions. Regardless of years of renovations in car safety, an approximated 31,785 people passed away in traffic mishaps on U.S.

Little Known Facts About Hsmb Advisory Llc.

Comprehensive insurance coverage covers burglary and damages to your auto due to floods, hail storm, fire, vandalism, falling items, and animal strikes. When you fund your vehicle or rent a car, this kind of insurance policy is compulsory. Uninsured/underinsured driver (UM) coverage: If a without insurance or underinsured motorist strikes your car, this insurance coverage pays for you and your passenger's medical expenses and may likewise represent lost income or make up for pain and suffering.

Company coverage is usually the very best alternative, but if that is inaccessible, get quotes from several carriers as many provide discounts if you purchase greater than one sort of coverage. (https://forums.hostsearch.com/member.php?256834-hsmbadvisory)

Not known Facts About Hsmb Advisory Llc

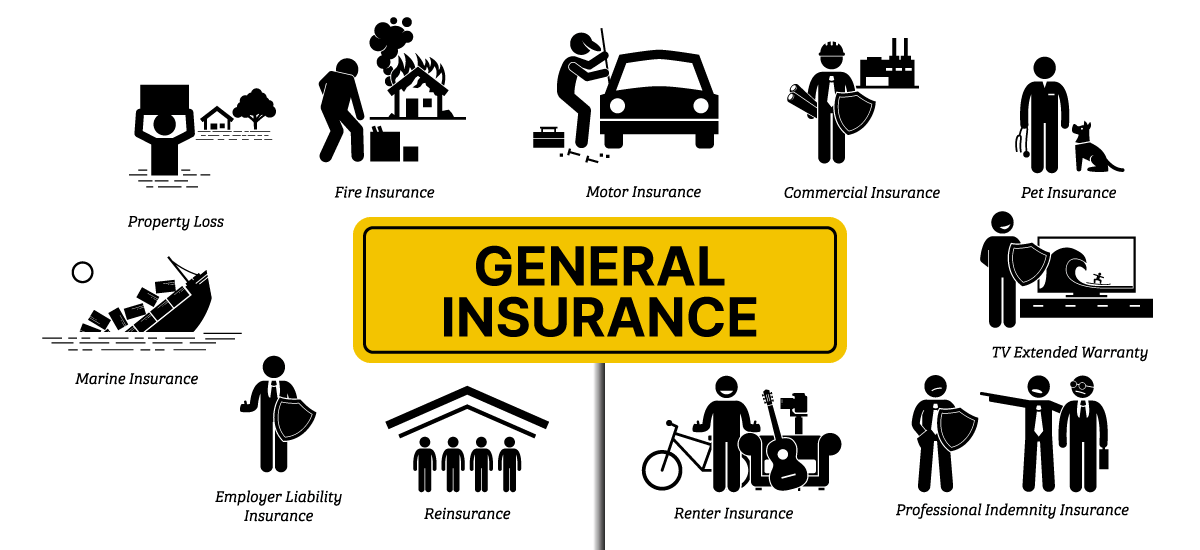

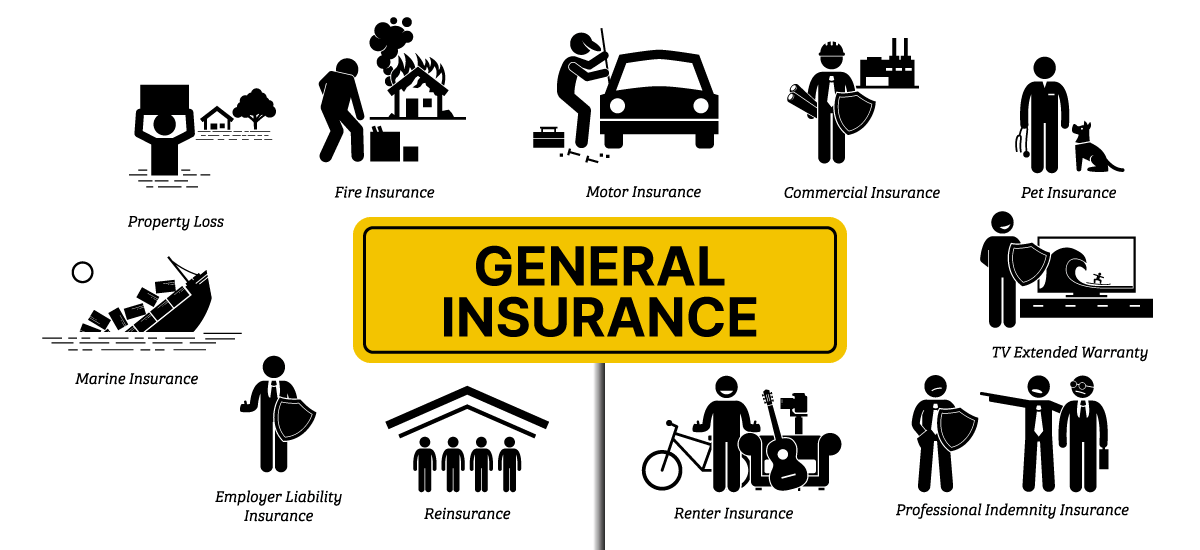

In between medical insurance, life insurance policy, impairment, responsibility, long-term, and also laptop insurance, the task of covering yourselfand considering the endless possibilities of what can occur in lifecan really feel frustrating. But when you understand the basics and ensure you're adequately covered, insurance coverage can increase economic self-confidence and wellness. Right here are one of the most vital kinds of insurance you require and what they do, plus a couple suggestions to prevent overinsuring.

Various states have different regulations, however you can anticipate health insurance coverage (which many individuals survive their company), vehicle insurance (if you own or drive a car), and house owners insurance (if you own home) to be on the checklist (https://hsmbadvisory.jimdosite.com/). Mandatory kinds of insurance coverage can change, so check up on the newest laws once in a while, specifically prior to you restore your policies